💸 Top Tax Deductions Small Businesses Overlook (And How to Maximize Them)

As a small business owner, every dollar counts — especially during tax season. Yet, many businesses leave money on the table by missing out on legitimate tax deductions they’re entitled to claim.

In this post, we’ll walk you through the most commonly overlooked tax deductions, why they matter, and how professional guidance can help you legally lower your tax bill.

If you’ve been wondering whether it’s time to outsource your bookkeeping, this post is for you.

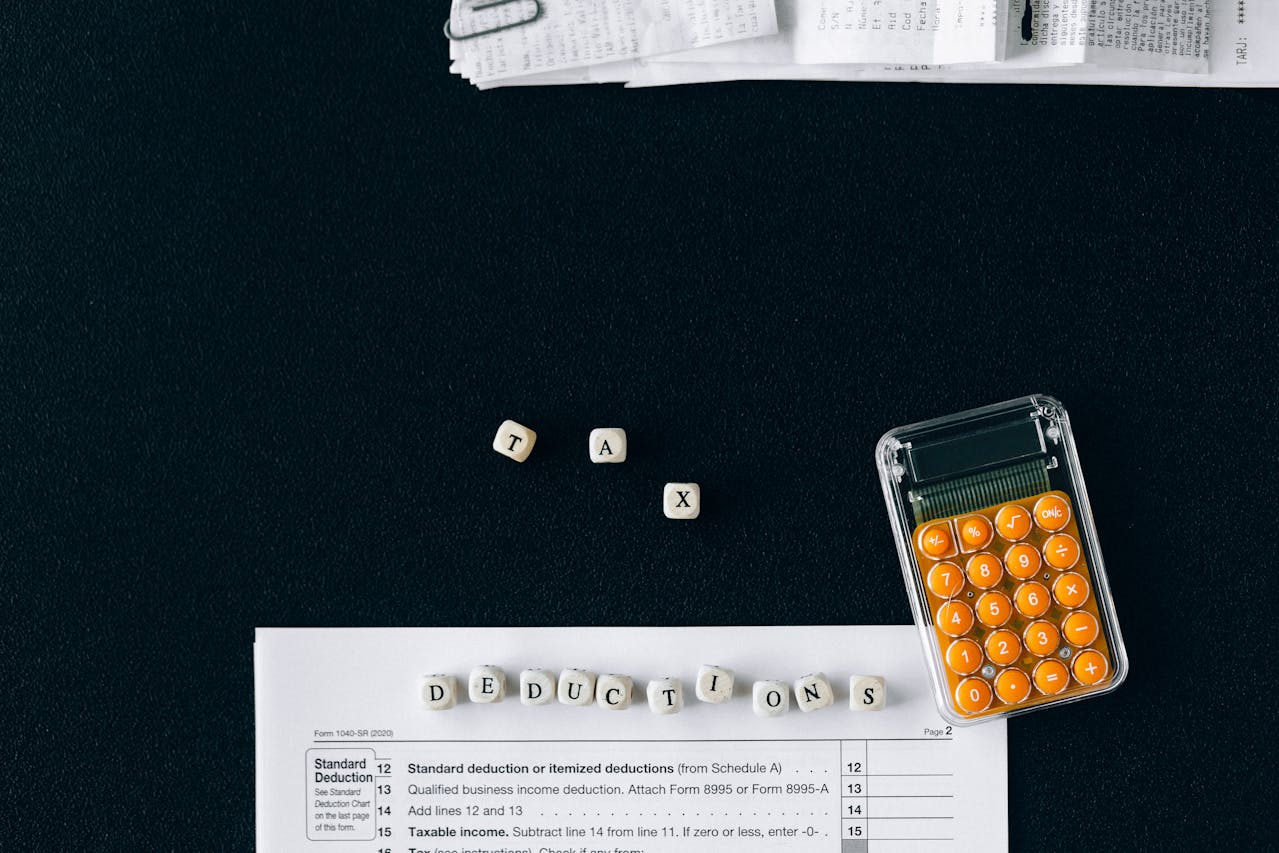

1. Home Office Deduction

Do you work from a dedicated space in your home? If so, you may qualify for the home office deduction, which lets you write off a portion of your rent or mortgage, utilities, and more.

-

2. Professional Services

Payments to accountants, consultants, bookkeepers, legal advisors, or virtual assistants are all fully deductible as business expenses.

3. Retirement Contributions (for Self-Employed)

Solo 401(k), SEP IRA, and other self-employed retirement accounts allow you to lower your taxable income while saving for the future.

4. Bank Fees and Payment Processing Costs

Monthly bank fees, credit card processing fees (from Stripe, PayPal, etc.), or wire transfer costs — these are all deductible business expenses.

5. Bad Debts (in Certain Cases)

If you invoiced a client but never got paid — and you can prove it was a business-related loss — you may be able to deduct that “bad debt” under IRS rules.

🔎 Why You Might Be Missing These Deductions

Many small businesses:

-

Use personal accounts without tracking

-

Forget to organize receipts

-

Don’t know which expenses qualify

-

File taxes without professional help

💼 How KoyaFin Helps You Maximize Every Deduction

At KoyaFin, we help business owners:

-

Stay organized year-round

-

Identify overlooked deductions

-

Keep clean, audit-ready books

-

Legally reduce their tax burden

📩 Want to stop overpaying taxes?

Schedule a Free Consultation with our expert bookkeeping and tax support team.