Monthly Bookkeeping Checklist for California Business Owners

Running a business in California comes with its own financial rules and tax obligations. Keeping up with your bookkeeping each month not only helps you stay compliant but also ensures your business is financially healthy and tax-ready.

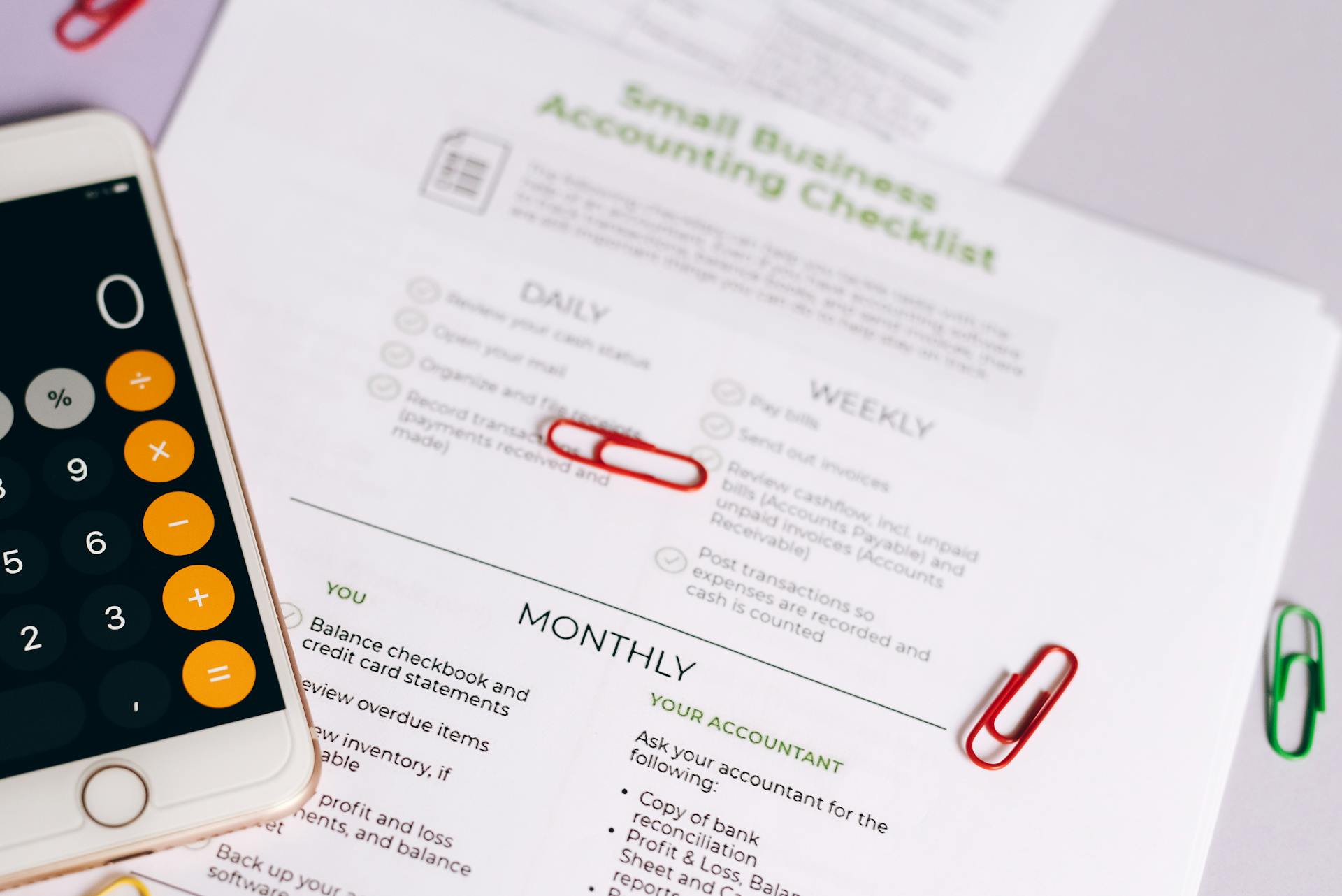

Here’s a practical monthly bookkeeping checklist every California business owner should follow.

1. Reconcile Bank and Credit Card Statements

Always start by reconciling your business bank accounts and credit cards. Match each transaction with your bookkeeping records to catch discrepancies early.

2. Review and Categorize Transactions

Ensure all income and expenses are properly categorized. This helps track cash flow and makes filing taxes easier at the end of the year.

3. Track and Record Receipts

In California, keeping detailed records is critical. Use accounting software or cloud storage to upload receipts for business-related purchases and expenses.

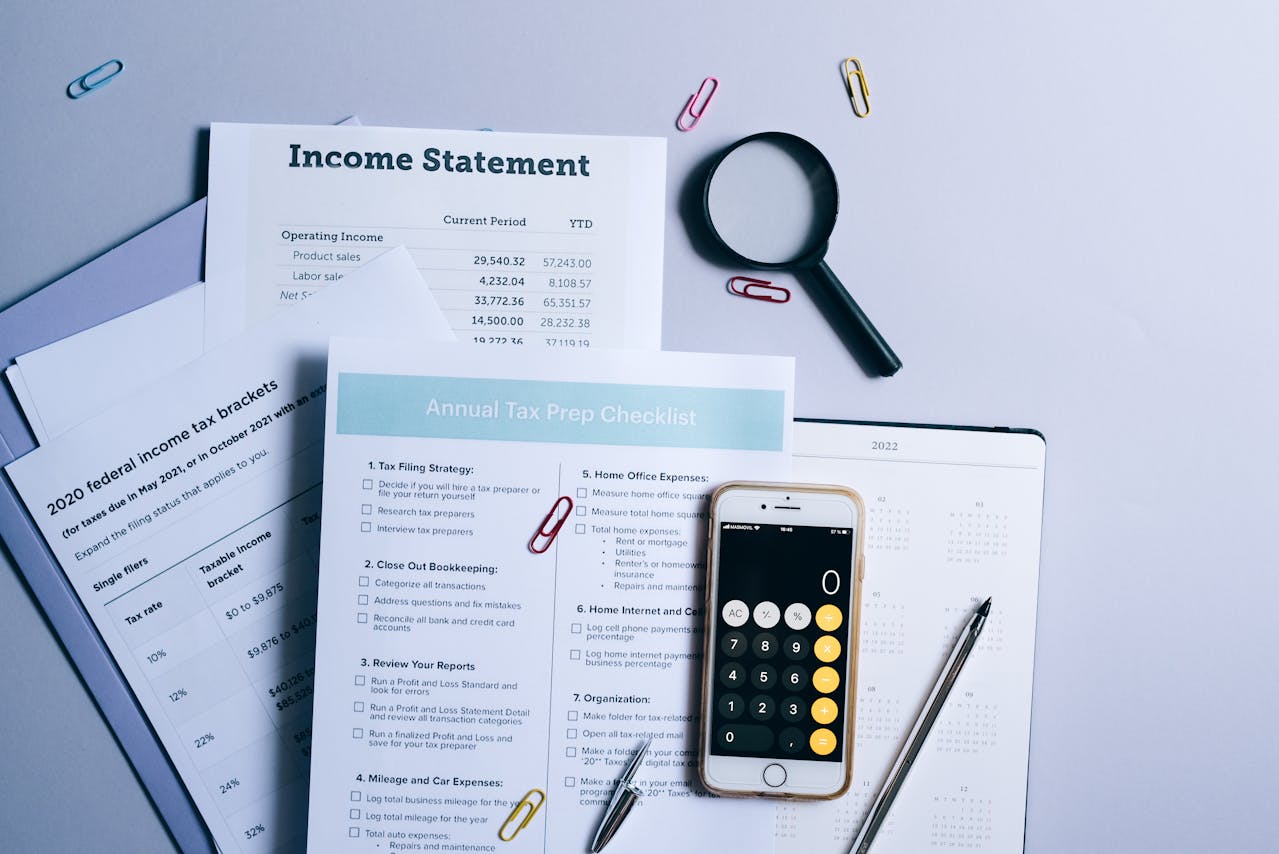

4. Generate and Review Financial Statements

Generate a Profit & Loss statement and Balance Sheet each month. These documents offer a snapshot of your business’s performance and help with strategic planning.

5. Pay Sales Tax (If Applicable)

If your business collects sales tax in California, ensure payments are made accurately and on time through the CDTFA (California Department of Tax and Fee Administration).

6. Update Payroll Records

Keep employee payroll records up to date. Verify all deductions, benefits, and wages comply with California’s labor laws and tax regulations.

7. Review Accounts Payable and Receivable

Check which invoices are unpaid or overdue and follow up. Also, settle any bills your business owes to maintain good vendor relationships.

8. Backup Financial Data

Protect your business from data loss by backing up your financial records monthly—ideally both in the cloud and offline.

9. Prepare for Quarterly Taxes

Use your monthly financial data to estimate and set aside funds for quarterly tax payments to avoid penalties.

10. Consult with a Bookkeeper or CPA

A professional bookkeeper familiar with California’s tax code can help spot potential issues before they become problems and offer insights for better financial planning.

A monthly bookkeeping routine is essential for staying compliant and gaining insight into your business finances. By following this checklist, California business owners can reduce stress, avoid surprises, and be ready for whatever comes next.